05 Mar

04 Mar

Mortgage rule changes are expanding insured market activity, insurers say

[#item_full_content]

02 Mar

26 Feb

Peak renewal year dominates discussion as MPC kicks off national symposium tour

[#item_full_content]

24 Feb

20 Feb

Five-year prison terms handed to Fortress founders in mortgage fraud case

[#item_full_content]

18 Feb

Highclere Capital offering up to 50 bps at renewal in new broker incentive

[#item_full_content]

17 Feb

13 Feb

13 Feb

Clock ticking for Ontario mortgage brokers to complete required training

[#item_full_content]

12 Feb

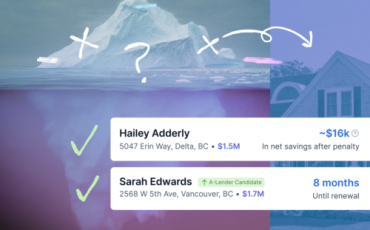

Mortgage brokers share options for homeowners facing a mortgage non-renewal

[#item_full_content]

12 Feb

Brokers weigh benefits and trade-offs of Nova Scotia’s 2% down payment pilot

[#item_full_content]

07 Feb

Remembering Christine Buemann, a quiet force in Canada’s mortgage industry

[#item_full_content]

06 Feb

Ontario review recommends expanding lender access for Level 1 mortgage agents

[#item_full_content]

05 Feb

Equitable Bank returns to prime lending with exclusive DLCG partnership

[#item_full_content]

05 Feb

Laurentian shareholders give near-unanimous backing to $1.9B Fairstone deal

[#item_full_content]

05 Feb

05 Feb

04 Feb

N.S. pilot program cuts down payment requirements for first-time homebuyers

[#item_full_content]

03 Feb