- 489 Queen St E Unit 202, Toronto, ON M5A 1V1

- Mon - Fri: 9 am - 5 pm, Sunday: CLOSED

- (416) 251-5434

Home Trust enters reverse mortgage market with launch of EquityAccess

Home Trust enters reverse mortgage market with launch of EquityAccess Home Trust enters Canada’s reverse mortgage market with a new broker-exclusive product launched at MPC’s National Mortgage Conference.

Nesto Group takes equity stake in Maple Financial through CMLS

Nesto Group takes equity stake in Maple Financial through CMLS The investment links Maple’s alternative lending business with Nesto’s technology platform and CMLS’s national distribution network.

First National raises $800 million in bond sale ahead of private equity takeover

First National raises $800 million in bond sale ahead of private equity takeover The non-bank lender upsized its bond sale to $800 million ahead of its planned acquisition by Birch Hill Equity Partners and Brookfield Asset Management, with proceeds earmarked to repay existing debt and support the buyout.

Scotiabank to cut jobs across its Canadian banking unit

Scotiabank to cut jobs across its Canadian banking unit Bank of Nova Scotia is cutting jobs across its Canadian banking division as part of the firm’s effort to boost long-term profitability.

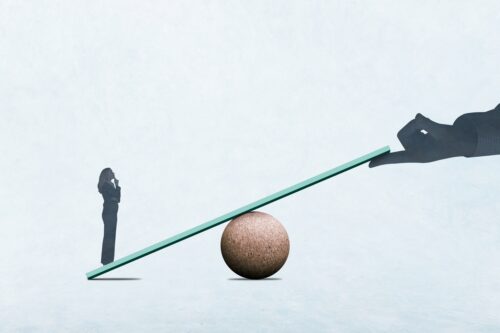

Opinion: When competition crosses a line in mortgage brokering

Opinion: When competition crosses a line in mortgage brokering Every so often, a situation comes along that reminds us of a darker side of mortgage brokering. Most of the time, competition is healthy. But sometimes, it crosses a line; not legally, but ethically.

Mortgage Digest: Easing homeownership costs may be short-lived, RBC says

Mortgage Digest: Easing homeownership costs may be short-lived, RBC says Inside: mortgage arrears inch higher, Manulife teams up with M3, Haventree joins CMHC securitization programs and more career updates.

Equifax says mortgage fraud is down, but falsified documents remain rampant

Equifax says mortgage fraud is down, but falsified documents remain rampant Mortgage fraud in Canada may be easing overall, but Equifax Canada’s latest data suggest that what’s left is becoming more sophisticated.

InterRent receives Investment Canada Act approval for takeover deal

InterRent receives Investment Canada Act approval for takeover deal InterRent Real Estate Investment Trust says it has received Investment Canada Act approval for its deal to be acquired by a group including executive chair Mike McGahan and Singapore sovereign wealth fund GIC.

TD pledges to cut billions in costs as it restores guidance

TD pledges to cut billions in costs as it restores guidance Toronto-Dominion Bank is reinstating guidance on growth — with similar targets to those in place before a U.S. money-laundering scandal — as it pledges to slash billions in annual costs and boost revenue through a push to attract more clients and sell them additional products.

TD’s U.S. investment-banking ambitions risk leaving Canada behind

TD’s U.S. investment-banking ambitions risk leaving Canada behind As hundreds of TD Securities managing directors gathered at the Encore hotel overlooking Boston Harbor in June, there was a celebratory atmosphere in the air. Less publicly, there was grousing as well.